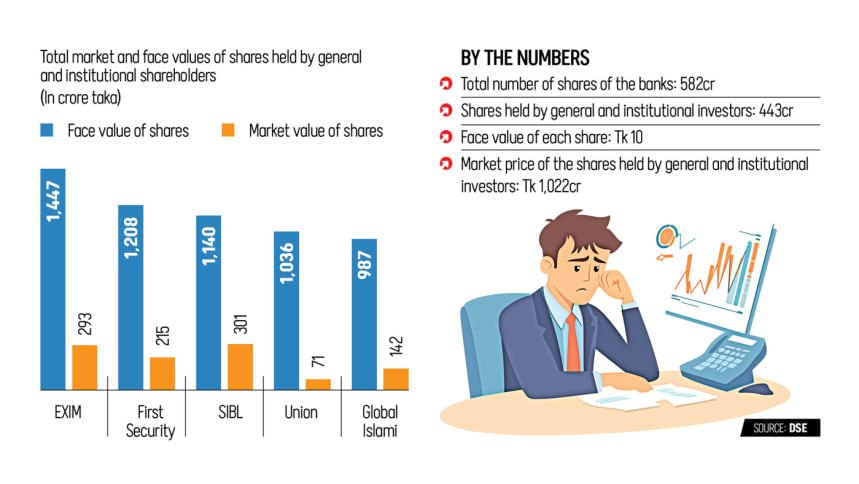

Shareholders of five Islamic banks facing financial difficulties experienced substantial losses following an announcement by the central bank that their shares were now worthless. The total loss incurred by these shareholders amounts to approximately Tk 4,500 crore, equivalent to the face value of the stocks. Despite the face value, the market value of these shares was significantly lower, resulting in a loss of around Tk 1,022 crore.

In response to the merger directive issued by the Bangladesh Bank (BB), trading of the bank shares was suspended by the Dhaka and Chattogram stock exchanges. The banks involved in the merger are First Security Islami Bank, EXIM Bank, Social Islami Bank, Union Bank, and Global Islami Bank. The central bank clarified that it had no legal obligation towards the shareholders, emphasizing that any government intervention would be a separate matter.

Data from the Dhaka Stock Exchange (DSE) revealed that these banks collectively issued approximately 582 crore shares with a face value of Tk 10 each, resulting in a total paid-up capital of Tk 5,820 crore. The majority of shares, amounting to 76 percent or 443 crore, are held by general and institutional shareholders. Consequently, these investors are facing losses concerning shares with a face value of Tk 4,433 crore, while the market value stands at Tk 1,022 crore.

Despite assurances from the finance ministry that investors would not be adversely affected by the merger, BB Governor Ahsan H Mansur announced that shareholders of the five banks would not receive any stake in the new bank due to the negative net asset value per share, ranging from Tk 350 to Tk 420. This means that the assets held by the banks are insufficient to cover their liabilities.

Saiful Islam, president of the DSE Brokers’ Association of Bangladesh (DBA), acknowledged the challenges faced by investors who relied on allegedly fraudulent financial statements prepared by sponsors, regulators, and auditors. He suggested that the government might consider offering shares to small investors as a special measure.

Asif Khan, president of CFA Society Bangladesh, disputed the characterization of the process as a merger, describing it as a taxpayer-funded bail-out for depositors. Khan asserted that the banks lacked adequate assets to cover their liabilities and were effectively bankrupt. He emphasized that depositors would be the priority for repayment under the law, given the government’s limited fiscal capacity due to its compliance with strict IMF targets.

The situation of the banks has raised concerns among stock investors like Mizanur Rahman, who called for government compensation to affected shareholders. Rahman highlighted the potential negative impact on the market if investors do not receive shares in the new bank and expressed disappointment over the perceived lack of attention to stock investors compared to depositors.

A senior official from a merchant bank underscored the precedence of depositors over shareholders in case of bank insolvency, noting that shareholders were not entitled to compensation due to the negative net asset value per share. The official recommended that any additional government funds be directed towards depositors rather than shareholders, given the financial constraints and obligations faced by the banks.