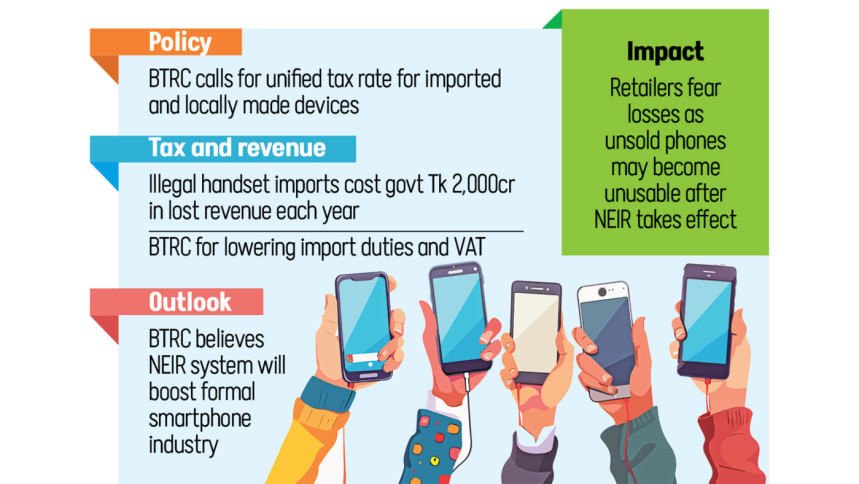

The Bangladesh Telecommunication Regulatory Commission (BTRC) has urged relevant government agencies to establish a tax rate for unsold mobile phones that were illicitly imported and are currently stocked in retail outlets. Additionally, a definitive timeline for legalizing these devices is being sought.

In a recent communication, the regulator also recommended a review of import duties and VAT on mobile phones, advocating for a uniform tax framework that applies equally to both imported and domestically manufactured devices. The letter was dispatched to the Posts and Telecommunications Division and shared with the National Board of Revenue (NBR), as per insiders familiar with the situation.

The necessity for a well-defined policy has intensified due to the impending launch of the National Equipment Identity Register (NEIR), a system set to bar unregistered, duplicate-IMEI, or falsely registered phones from connecting to mobile networks after December 16, 2025. While phones already in operation before the NEIR implementation will remain unaffected, unactivated devices, many of which are currently on display in retail stores, face an uncertain fate.

Concerns raised by retailers to the BTRC emphasize the critical need for a streamlined process to legitimize these devices to prevent a surplus of unsellable stock post-NEIR enforcement.

Chairman of the BTRC, Md Emdad-ul-Bari, declared, “Per our jurisdiction, we intend to register the unsold handsets in circulation.” However, the pivotal issue revolves around whether this registration would entail tax payments, a decision left to the discretion of the NBR.

The BTRC’s communication references NBR estimates indicating annual revenue losses of approximately Tk 2,000 crore due to illegal handset imports that evade duty and VAT payments, undercutting compliant importers and placing local manufacturers at a competitive disadvantage.

Highlighting that Bangladesh’s current handset tax structure surpasses that of many analogous markets, the commission contends that this leads to inflated consumer prices and discourages legal import or production of devices, despite a 63 percent smartphone penetration rate in the country.

The BTRC emphasizes the necessity of fostering equitable competition between locally manufactured and imported phones, stressing that without tax policy alignment, local producers will continue to face unfair challenges, especially against unlawfully imported handsets that bypass tax obligations.

Advocating for a harmonized tax system to safeguard the interests of all stakeholders and boost consumer trust, the commission anticipates a significant decrease in illegal handset usage once NEIR is enacted. This transition towards legally imported and domestically produced smartphones, it believes, will stimulate industry growth and bolster the national economy.